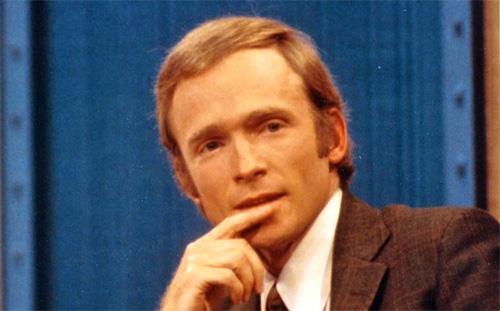

Eight years ago, I wheedled and finagled to land a phone interview with Dick Cavett, one that produced two TV Worth Watching stories. One of the employed wheedles was to promise Mr. Cavett that I would take up no more than 30 minutes of his time.

Interviewing the man is almost as fascinating as watching him interview others — as long as you mostly listen. I did, carefully writing pages of notes as he told one tremendously interesting story after another.

But, just as commercials used to interrupt his shows, the storyteller ended the storytelling seance, with a friendly but simple: "Is my half-hour up yet?"

I retell this story now because the man who carefully watched his clock has become accessible again, in a manner of speaking. Decades, one of many low-profile TV networks that specialize in serving up vintage programs, recently was added to my cable lineup. Weeknights at 9 p.m. ET, Cavett fans can watch again one of the best interviewers ever in the talk-show genre — one free from today's promotional presence of guests that make talk shows more like transactions than visits.

Pointing out this sighting probably is important to the many Cavett fans (as well as those who will love seeing him for the first time) because itty-bitty Decades will never have a Netflix-type of presence.

Three of the reasons Cavett is so good: He listens and lets the interview follow the guest's response; his mind is full of facts relevant to the interview, and he retrieves these facts effortlessly; he almost always is so low-key in his questions that doing so keeps the spotlight on the guest, rather than him.

Starting in the late '60s and up through the late '90s, Cavett's shows were carried on several commercial networks and PBS. Perhaps because Decades is so low-profile, a request to a peripherally connected executive for a listing of how many of these series the network has access to has not yet received a response.

So there's no way of knowing whether the interviews with John Lennon and Yoko Ono, Katharine Hepburn, Groucho Marx, Fred Astaire, and some of the other legends who gave great interviews will show up. (If the one in which Gore Vidal and Norman Mailer's trading of insults airs, it has the strange fascination of watching cars crash and shouldn't be missed.)

But whether the network has a full treasure chest of episodes or just select doubloons, its existence remains very notable. Cavett was able to book truly memorable guests, interview them with intelligence and humor, and make fans wish, at the end of the show, it somehow could go on even longer. Which is another way of defining "TV worth watching."